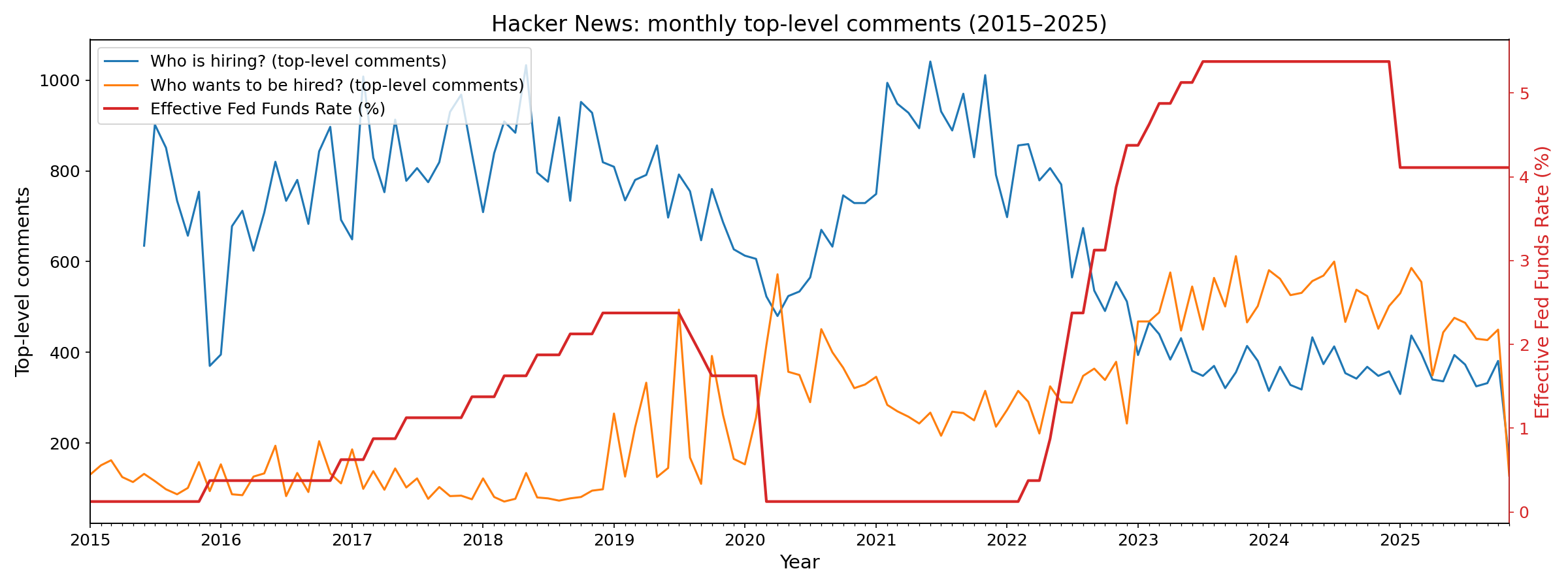

Tech hiring still hasn’t recovered from 2022 — and may not soon.

Hacker News has run two companion threads every month for more than a decade: Who is hiring? for companies and Who wants to be hired? for job seekers. I pulled the top-level comment counts for both threads from 2015 through 2025 and set them against the Effective Federal Funds Rate.

Here is some data from the LinkedIn Workforce Report. It correlates with HN data.

| Industry | Jan 2023 | Jan 2024 | Oct 2024 | Nov 2024 | Dec 2024 | Jan 2025 | YoY Change |

|---|---|---|---|---|---|---|---|

| Professional Services | 1.02 | 0.92 | 0.86 | 0.86 | 0.89 | 0.87 | -5.2% |

| Technology, Information and Media | 0.92 | 0.84 | 0.84 | 0.82 | 0.92 | 0.85 | +1.5% |

Methodology: "Hiring Rate" is the count of hires (LinkedIn members in each industry who added a new employer to their profile in the same month the new job began), divided by the total number of LinkedIn members in the U.S. By only analyzing the timeliest data, we can make accurate month-to-month comparisons and account for any potential lags in members updating their profiles. This number is indexed to the average month in 2016 for each industry; for example, an index of 1.05 indicates a hiring rate that is 5% higher than the average month in 2016.

The tech job market hasn’t recovered since the 2022 downturn. If current monetary trends hold, a meaningful recovery is unlikely before 2027. The one factor working in job seekers’ favor: demographics. Gen Z is the smallest generation since World War II, and Boomers are retiring en masse. That shrinking labor pool won’t cause a hiring boom on its own, but it will reduce supply — and could gradually shift leverage back toward engineers as the decade closes.